Home » Blog » Transmission and Reliability Management » A Bright Future for Western EIM Entities

A Bright Future for Western EIM Entities

The publication of Q3 Western Energy Imbalance Market (EIM) Benefits Report on October 18, 2017 was nearly a non-event, the estimated gross benefits of over $40 million for this quarter alone notwithstanding. The fact that Market Participants and the various stakeholders expected nothing else, and the fact that during this quarter the Western EIM enabled the use of 23,331 MWh of excess green power to displace 9,986 metric tons of CO2 emissions is no longer newsworthy, but an acceptable part of mainstream economics of the Western Interconnection, is a significant development.

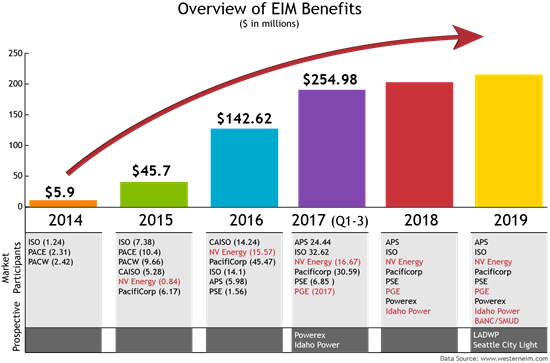

You only need to look back to 2014, a mere three years ago, when Balancing Authorities (BAs) in the West held a collective breath to await the outcome of Warren Buffet’s bet on the CAISO’s EIM venture. How times have changed. With the success of the market guaranteed with regular savings a cumulative total of $254.98 M, more entities are joining and many more have reached agreements to enter the market in the years ahead.

What has led to this huge success? While this may be obvious especially with the data to prove it as shown on the diagram below, understanding the factors that have led to the market’s ability to deliver savings to participating entities while limiting their environmental footprint is important especially to prospective Market Participants. Top of the list of the contributing factors is technology. As a matter of fact, the first statement you read on the Western EIM website is: “EIM uses advanced market systems to automatically find lowest-cost energy to serve real-time customer demand across a wide geographic area.” With this advanced system, energy transfers between Balancing Authority Areas (BAAs) and renewable generation that would have been curtailed either through economic or exceptional dispatch have been successfully integrated. In addition, as the EIM’s footprint has grown, the benefits to its entities have grown exponentially as shown in the diagram below.

Given the role technology plays in helping make the Western EIM a win-win for all stakeholders, getting Western EIM software to facilitate participation is a prerequisite to entry. According to OATI’s EIM expert, Mehdi Assadian, the success of entities is shaped by the energy market management system they adopt and deploy prior to their participation in the Real-Time Market (RTM). In Mehdi’s Western EIM blog post on this subject he asserts that “without an advanced energy market management software, a BA especially one participating in an EIM, is very likely going to fail.” Mehdi’s statement echoes that made by the Market Operator (MO) about the central role technology plays in the Western EIM.

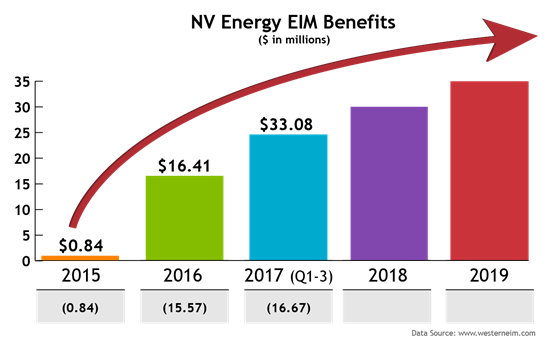

As the Western EIM has grown, the technology needs have expanded and the systems have become more sophisticated. What this means is that deciding on a Western EIM software partner can be a daunting proposition because there is so much at stake for the BA. With OATI, this needs not be a painful process. Whether it is working on understanding how joining the market will change the day-to-day operations of the entity in question, the time-sensitive data exchange needs between the entity and the MO, the technology to facilitate the sophisticated market processes and a powerful shadow settlement engine to ensure that the entity’s savings are accurately calculated, OATI has the experience and expertise to deliver both the training and Western EIM software solution to help entities meet their business goals. The results presently enjoyed by NV Energy and soon to be enjoyed by Portland General—current users of OATI Western EIM software solution to participate in the market, as well as Idaho Power and SMUD with future OATI production implementations—provide a good example on OATI’s benefits-driven approach to Market Participation.

In Q3 of 2017 alone, NV Energy’s benefits were a staggering $8.55 million. This practically doubles their Q1&2 benefits of $8.12 million, bringing NV Energy’s cumulative benefits total to $33.08 million as shown in the chart above.

This sustained success by NV Energy in the Western EIM has been facilitated by a number of factors including the expertise of their staff, an excellent corporate vision, and most importantly, foresight to deploy to sophisticated Western EIM software solution OATI webEIM, that has both the capability to provide comprehensive automated functionalities for participating in the Day-Ahead (DA) and RTMs, and the shadow settlement engine that ensures that NV Energy transactions with the market are accurately calculated.

For NV Energy, Portland General, Idaho Power, and SMUD already deploying the OATI Western EIM software solution, they can move into 2018 and the years ahead comfortable in the thought that their software vendor will continue to help them meet and exceed their business goals in this stable energy imbalance marketplace.

For more information on NV Energy’s use of OATI webEIM solution, request a case study.

About the Author:

Paris Amani, Senior Director – Project Group, OATI

Mr. Paris Amani has eight years of experience in the electric power business, managing power applications. Mr. Amani is currently a Senior Director at OATI where he manages a team of Directors and Project Managers. He is also a Subject Matter Expert (SME) for the SPP market. Mr. Amani was a contributor to the successful launch of the OATI SPP Integrated Market solution that went live on March 01, 2014, as well as the CAISO EIM that went live on December 01, 2015. Mr. Amani was named 2012 OATI President Award recipient. This award is given to the employee that best represents OATI’s commitment to its customers. Mr. Amani was also awarded the 2015 OATI Top Team Award for the successful implementation of NV Energy webEIM Solution. This award is given to a Team for outstanding dedication and customer-first attitude that results in success for OATI customers.

- December 26, 2017